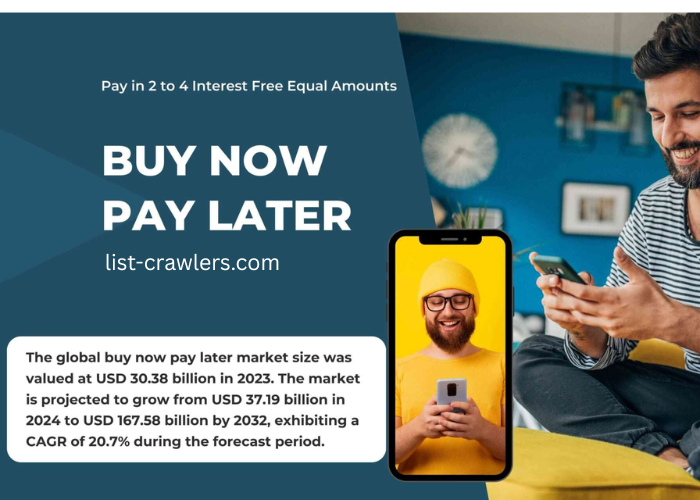

In recent years, Buy Now, Pay Later (BNPL) services have surged in popularity, offering consumers a new way to shop without immediate financial strain. From online shopping carts to retail stores, BNPL options are everywhere, promising convenience and flexibility . But what exactly are these services, how do they work, and what should you know before using them? Let’s uncover the truth about Buy Now, Pay Later services and bank of norracotransact and what they mean for your finances.

What Are Buy Now, Pay Later Services?

Buy Now, Pay Later services allow consumers to purchase products immediately but delay payment through installments over weeks or months, often with little or no interest. Popular providers include Afterpay, Klarna, Affirm, and PayPal’s Pay in 4, among others.

These services are designed to make purchases more affordable by spreading out payments. For example, instead of paying $300 upfront for a new gadget, you might pay $75 every two weeks over two months.

How Does Buy Now, Pay Later Work?

The process is straightforward:

- Choose BNPL at Checkout: When shopping online or in-store, you select the BNPL option as your payment method.

- Get Approved Instantly: Most BNPL providers perform a quick credit check or soft inquiry with minimal impact on your credit score.

- Pay Over Time: The total cost is divided into equal installments, which you pay according to the agreed schedule.

- No Interest or Fees (If Paid On Time): Many BNPL plans charge zero interest if you make payments on schedule.

Benefits of Buy Now, Pay Later Services

1. Improved Cash Flow and Budgeting

BNPL can help manage cash flow by allowing you to spread out payments. This flexibility can make budgeting easier, especially for larger purchases.

2. Easy Approval

Unlike traditional credit cards or loans, BNPL services often require minimal credit history, making them accessible to more people.

3. Interest-Free Options

If payments are made on time, many BNPL plans charge no interest, making them an affordable alternative to credit cards.

4. Convenience

The seamless integration of BNPL options at checkout makes the anime show in raretoonsindia fast and hassle-free.

The Hidden Truths and Risks of Buy Now, Pay Later

While BNPL services offer undeniable convenience, it’s important to be aware of their potential downsides:

1. Late Fees and Penalties

Missing payments or paying late can lead to fees that quickly add up. Unlike interest-free offers, these penalties can negate any financial benefit.

2. Encouragement of Overspending

Because BNPL reduces the immediate pain of payment, it may encourage consumers to buy more than they can afford, leading to financial strain.

3. Impact on Credit Scores

Although most BNPL providers do soft credit checks, failure to pay can be reported to credit bureaus, potentially harming your credit score.

4. Limited Consumer Protections

Unlike credit cards, BNPL purchases may not offer the same level of fraud protection or dispute resolution.

5. Complex Terms and Conditions

Some BNPL plans have confusing or restrictive terms, such as shorter payment windows or conditions for returns and refunds.

How to Use Buy Now, Pay Later Services Responsibly

If you decide to use BNPL, here are some tips to keep your finances healthy:

- Budget Carefully: Only use BNPL for purchases you can afford to pay off within the installment period.

- Read the Fine Print: Understand the payment schedule, fees, and penalties before committing.

- Set Reminders: Avoid late payments by setting alerts or automating payments.

- Limit Usage: Don’t rely on BNPL for everyday purchases; treat it as a tool for occasional, planned buys.

- Monitor Your Spending: Keep track of all active BNPL plans to avoid overextending your finances.

BNPL vs. Traditional Credit: Which Is Better?

Both BNPL and traditional credit options have their place, depending on your needs:

- BNPL offers simplicity, ease of approval, and short-term interest-free payments, making it ideal for controlled, small to medium purchases.

- Credit Cards provide longer-term borrowing, rewards, and stronger consumer protections but often come with higher interest rates if balances aren’t paid in full.

Choosing between them depends on your financial discipline and the nature of your purchases.

The Future of Buy Now, Pay Later

The BNPL market is growing rapidly, with more retailers integrating these options and new players entering the space. Regulators in several countries are also examining how to ensure consumer protection and transparency.

As BNPL becomes more mainstream, education about its use and risks will be essential for consumers to make informed decisions.

Final Thoughts

Buy Now, Pay Later services offer an attractive alternative to traditional credit, with the promise of flexible, interest-free payments. However, like any financial tool, they come with risks that require careful consideration. Understanding how BNPL works, recognizing potential pitfalls, and using these services responsibly can help you enjoy the benefits without damaging your financial health.

Before clicking “Buy Now, Pay Later,” pause and ask yourself: Can I afford this? If the answer is yes, BNPL might be a useful way to manage your purchases. If not, it’s better to rethink the purchase or explore other payment options.